Budget 2026: Why Your Study Abroad Dreams Just Got Significantly More Affordable

In the 2026 Union Budget, the Indian government introduced a significant tax reform that act as a breath of fresh air for anyone planning to study abroad. If you’re preparing for a move to the UK, the USA, or Europe, this update directly impacts your bank balance before you even board your flight.

Here is a breakdown of how the 2026 Budget is making your journey smoother and more affordable.

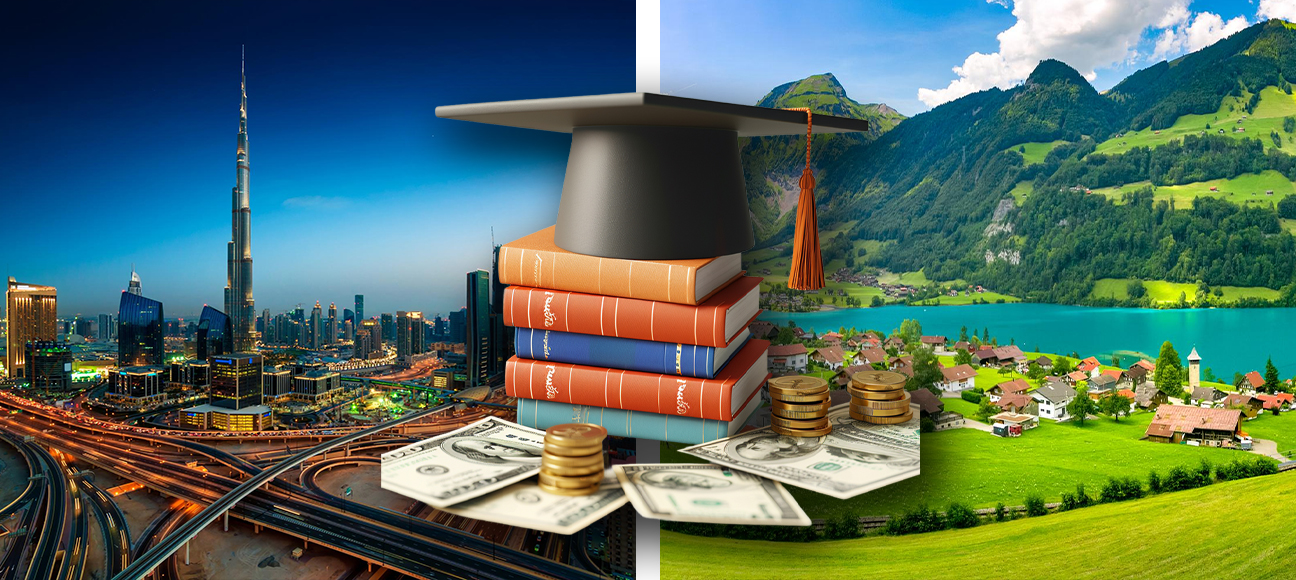

1. The Big Win: Slashed TCS Rates

The most important change is the reduction in Tax Collected at Source (TCS) for foreign education.

- The Old Rule: If your family sent more than ₹10 lakh abroad for your tuition or living costs using their savings the bank would collect a 5% tax upfront.

- The 2026 Update: This rate has been slashed to just 2%.

What this means for you:

Previously, sending ₹25 lakh for your Master’s tuition would have seen ₹75,000 “locked away” by the taxman (5% of the amount above the ₹10 lakh threshold). Under the new budget, that amount drops to ₹30,000. You essentially keep an extra ₹45,000 in your pocket immediately, which can be used for your visa fees, flight tickets, or initial rent.

2. Better “Liquidity” for Families

While TCS is eventually refundable or adjustable against your parents’ income tax, the problem was always the upfront cost.

- Reduced Pressure: By only taking 2%, the government ensures families don’t have to “over-arrange” funds just to cover the tax.

- Help for Germany-bound Students: If you’re heading to Germany and need to fund a Blocked Account (which often exceeds the ₹10 lakh limit), the lower TCS makes that initial transfer much less painful.

3. Remittance Through Loans

If you are funding your degree via an education loan from a recognised Indian band, you’re in an even better position.

- 0% TCS: For loans taken under specific sections (like Section 80E), the TCS remains at zero.

- The Strategy: If your family is debating between using life savings or a loan, the 2026 budget continues to make education loans the most tax-efficient way to pay for your degree.

4. The “Safety Net”: Foreign Asset Disclosure

Many students work part-time while abroad and keep some savings in a local bank account (like a Lloyds or Barclays account in the UK).

- The Scheme: The 2026 Budget introduced a one-time 6-month window to disclose any foreign bank accounts or assets.

- Why it helps: If you’ve returned to India or have siblings abroad who “forgot” to mention their foreign accounts in Indian tax filings, this is a “get out of jail free” card to declare them without heavy penalties.

Summary of Benefits for 2026 Aspirants

| Feature | Old Rule (Pre-2026) | New Rule (Budget 2026) |

|---|---|---|

| TCS on Self-funding | 5% (above ₹10L) | 2% (above ₹10L) |

| TCS on Education Loans | 0.5% or 0% | 0% (for compliant loans) |

| Upfront Cash Outflow | Higher | Significantly lower |

| Travel Packages | 5% to 20% | Flat 2% |

Pro Tip: When you or your parents go to the bank to transfer your tuition fees, ensure you mention that the funds are for “Education Purposes” to ensure you get the lower 2% rate rather than the standard 20% applied to other foreign spends.

Conclusion: Your Global Journey Just Got Leaner

Ultimately, the 2026 Union Budget serves as a major win for the international student community. By lowering the TCS barrier, the government has replaced “frozen funds” with immediate financial flexibility, allowing you to allocate your hard-earned savings toward what truly matters—your education and settling into your new home. While studying abroad remains a significant investment, these reforms ensure that the logistical hurdle of moving money across borders is no longer a drain on your initial budget. As you plan your departure, take advantage of these lower rates and the loan benefits to make your transition as cost-effective as possible. The world is waiting, and thanks to this budget, getting there is now a little bit lighter on your wallet.

Source: INDIA TODAY

Top Stories

China and Japan Release Safety Alerts for Students Amid Growing Tensions

November 19, 2025 | By Aahana

Australia Issues a Tough Warning Over Student Visa Integrity Threats

November 17, 2025 | By Henry

IELTS ‘Technical Glitch’ Sparks Global Score Chaos and Apology

November 13, 2025 | By Vaidant