US Tax Essentials for Indian Students on F-1 and J-1 Visas

2 Min Read

2 Min Read

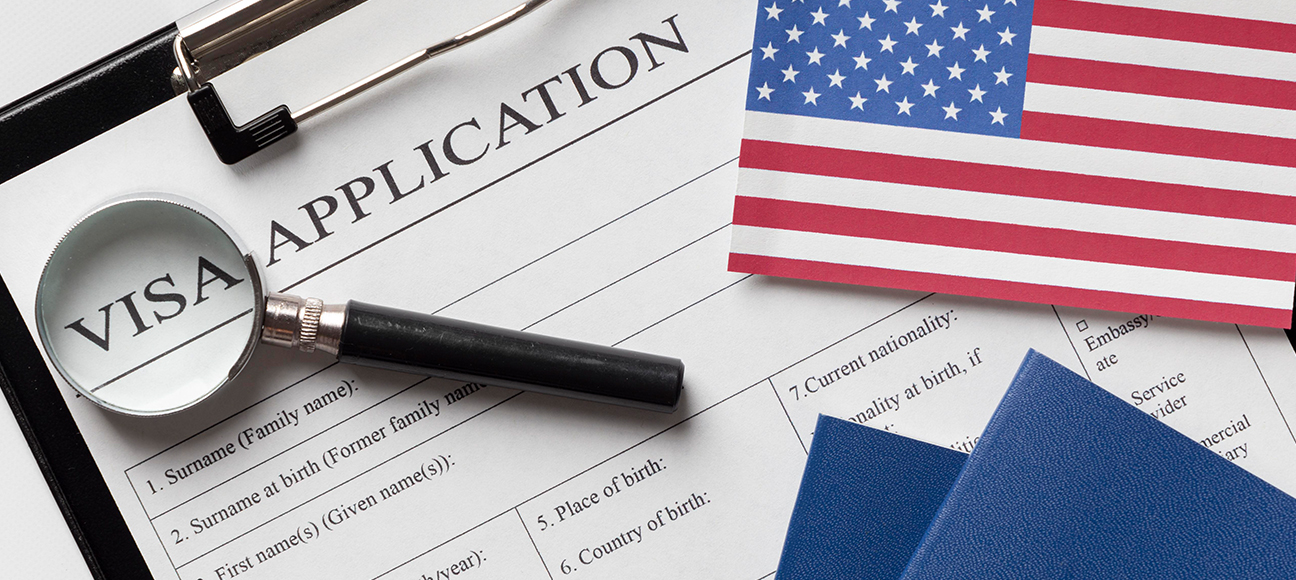

Indian students heading to the United States on F-1 (student) or J-1 (exchange visitor) visas must navigate a distinct set of tax regulations mandated by the Internal Revenue Service (IRS). Understanding these requirements is crucial for maintaining legal visa status and avoiding penalties.

For tax purposes, most F-1 and J-1 visa holders are classified as non-resident aliens during their initial years in the US. Generally, F-1 students retain this status for their first five calendar years, while J-1 students are typically non-resident for their first two.

After this exempt period, they may switch to resident alien status if they meet the Substantial Presence Test.

Crucially, every international student physically present in the US during the calendar year must file at least one form with the IRS, even if they had zero income.

The Form 8843 (Statement for Exempt Individuals) is mandatory for all F-1 and J-1 students and their dependents, regardless of income. It declares their status as an “exempt individual” for the Substantial Presence Test.

The Form 1040-NR (U.S. Non-resident Alien Income Tax Return) must be filed in addition to Form 8843 if the student earned any US-sourced income. This includes wages from on-campus employment, Curricular Practical Training (CPT), Optional Practical Training (OPT), or taxable scholarships/stipends.

A significant benefit for non-resident F-1 and J-1 students is the exemption from FICA taxes (Social Security and Medicare), which usually applies for their first five calendar years. This exemption covers wages paid for services performed to carry out the purpose of their visa, including CPT and OPT employment, provided they remain non-residents for tax purposes.

Indian students can also benefit from the U.S.-India tax treaty. While most non-residents cannot claim the standard deduction, Article 21 of this treaty permits Indian students to claim this deduction on their U.S. tax return, which can substantially reduce their tax liability.

Tax filing deadlines depend on the student’s income. The deadline for students who earned US-sourced income and must file Form 1040-NR (along with Form 8843) is April 15. However, the deadline is June 15 for students who had no US-sourced income and are only filing Form 8843.

Students who work in the US must obtain a Social Security Number (SSN). Those with no income but a taxable scholarship or grant need an Individual Taxpayer Identification Number (ITIN) to file.

Navigating US tax law is an indispensable responsibility for all international students. Understanding the classification as a non-resident alien, complying with the filing of Forms 8843 and 1040-NR, and being aware of beneficial exemptions and the India-US tax treaty are essential steps. By accurately filing their returns and observing the critical deadlines, Indian students can

Source: INDIA TODAY

Top Stories

Master’s Union: The Maverick Business School Set to Secure University Status

February 18, 2026 | By Aahana

Study Visits to Uzbekistan Surge by 54% in 2025 as International Interest Grows

February 2, 2026 | By Henry

Budget 2026: Your Study Abroad Dreams are Set to Become More Affordable

February 1, 2026 | By AahanaMore Articles

Canada’s International Student Numbers Plunge by 60% as Policy Shifts Bite

The landscape of Canadian higher education is undergoing a seismic shift. New data reveals that international student…

By Ezra

The Cost of Ambition: Why the UK’s New Visa Rules are Shutting Out Global Talent

The dream of building a career in the UK is becoming an expensive gamble for international students. While the UK…

By Vaidant

Australia’s Universities: Relying on Global Talent to Keep the Lights On

The latest figures from the Australian higher education sector have painted a sobering picture of a system under immense…

By Ezra

A Bridge Across Continents: McGill’s New £9.8m Alliance with UAE and Indonesia

In a significant move for international education, McGill University has announced a landmark trilateral partnership with…

By Neerav

A Bridge of Minds: Indian Academic Leaders Touch Down in the UK

The landscape of international education is shifting from simple student exchanges to a…

By Advay

Broken Dreams: The Pakistani Students Left in Limbo by UK Visa Delays

For hundreds of ambitious students across Pakistan, the dream of a British education is curdling into a…

By Jace

The Human Element: How India’s Students are Powering AI Revolution

India is standing at the threshold of a historic technological boom, with experts predicting the nation could…

By Ezra

Master’s Union: The Maverick Business School Set to Secure University Status

The traditional lecture hall is getting a long-overdue makeover. Master’s Union, the Gurugram-based business school that…

By Aahana

Study Visits to Uzbekistan Surge by 54% in 2025 as International Interest Grows

Uzbekistan has recorded a sharp rise in international education-related travel, with 37,200 foreign citizens…

By Henry

Budget 2026: Your Study Abroad Dreams are Set to Become More Affordable

In the 2026 Union Budget, the Indian government proposed a significant tax reform that act as a breath of fresh air for…

By Aahana

Asian Stakeholders Spot Fresh Opportunities in the UK’s Renewed International Education Strategy

Education leaders across Asia are pointing to renewed opportunity following the United Kingdom’s updated International…

By Daniel

OTHM Qualifications Aim to Build Global Trust Through Regulated Quality and Accessible Pathways

As global demand for recognised and flexible vocational education grows, OTHM Qualifications is positioning itself…

By Kai

US Higher Education Sector Backs Harvard in Legal Fight to Protect International Students

A broad coalition of major US higher education associations has stepped forward in support of Harvard University as…

By Henry

Proposed UK Student Levy Could Undermine Exchange Programmes and Outward Mobility

Concerns are rising across UK higher education over a proposed international student levy that could unintentionally damage…

By Siya

Interest from Nigerian Students in US Study Falls by Over 50% as Alternatives Gain Appeal

Interest among Nigerian students in pursuing higher education in the United States has fallen by more…

By Advay

US Congress Proposes $667 Million Boost for Study Abroad Funding

The United States Congress has moved to allocate a substantial USD $667 million to support study abroad and international exchange…

By Daniel

Asia Eyes Growth and Innovation to Shape the Future of International Education

As the global landscape of international education continues to evolve, 2026 is shaping up as a pivotal year…

By Jace

Harvard Sees Record International Enrolments Despite Political Pressure

Harvard University has reported a notable increase in international student enrolment for the current academic…

By Ezra

Modi Urges Top German Universities to Open Campuses in India to Boost Global Education Links

Prime Minister Narendra Modi has made a significant appeal to leading German universities to establish campuses in…

By Aahana

Crossing the Atlantic: What 2026 Holds for International Students in the US

The landscape of American higher education is undergoing a profound transformation as we move…

By Jace

Australia’s Education Sector Calls for ‘Stability First’ to Rebuild Global Trust in 2026

The Australian international education sector is entering 2026 with a singular, urgent plea for…

By Henry

US Court Backs Trump’s Decisive Move to Hike H-1B Visa Fees to $100,000

In a landmark ruling that has sent ripples through the global tech community, a federal…

By Ezra

A Landmark Year: How the Middle East Redefined Global Education in 2025

As 2025 draws to a close, the Middle East and North Africa (MENA) region is celebrating a transformative year…

By Neerav

Global Student Numbers Set to Hit 8.5 Million by 2030 Despite Growing Pains

The international education sector is on the verge of a massive expansion, with the number of students studying…

By Daniel

South Asia Education Review 2025: Key Stories and Emerging Trends

The landscape of international education in South Asia saw major shifts in 2025. While the desire to study abroad…

By Ezra

Top 10 European International Education News Stories of 2025

The landscape of international education in Europe shifted significantly in 2025. From new taxes…

By Jace

The Year Australia Redefined International Education

It has been a year of profound transformation for Australia’s international education sector. From the corridors…

By Advay

Indian University Enrolments Abroad Fall for First Time in Three Years

For the first time in three years, the rapid surge of Indian students heading to international universities has…

By Aahana

Doors to Russia Open Wide: New Entrance-Exam-Free Scholarships Announced for Indian Students

In a move set to further strengthen the long-standing educational ties between New Delhi and Moscow…

By Henry

US States Launch Legal ‘War’ Over $100,000 Visa Fee Hike

The battle for global talent has moved from the boardroom to the courtroom. A coalition of 20 US…

By Kai

A Helping Hand for India’s Brightest: British Council Unveils 2026-27 GREAT Scholarships

The dream of walking through the historic halls of a British university has just become a…

By Advay

Germany Becomes a Top Destination as International Student Numbers Surge

Germany has officially cemented its reputation as a powerhouse for global…

By Neerav

Bright Spots for Canadian Universities as Student Visa Approvals Bounce Back

After half a decade of tightening belts and mounting hurdles, Canada’s universities are finally seeing…

By Ezra

Why Chinese Students are Trading Global Ambitions for Local Roots

For decades, the standard path for China’s brightest minds was simple: study hard, head to a prestigious Western university, and…

By Siya

US Travel Ban Expansion: A New Chapter of Uncertainty for Global Students

The landscape of international education has been shaken once again as President Donald Trump announced a significant expansion…

By Jace

New Horizons: UK to Rejoin Erasmus+ Exchange Programme in 2027

In a move that has sparked widespread celebration across the education sector, the UK government has officially confirmed…

By Aahana

The Great Freeze: 75% of Canadian Universities Hit by International Student Slump

Canada’s long-standing reputation as a premier destination for global education is facing a significant test. According to…

By Ezra

UK Exams Watchdog Hits Pearson with £2 Million Fine Over Regulatory Failures

The UK’s exam regulator, Ofqual, has issued a series of heavy financial penalties to the education giant…

By Daniel

Passport to Promotion: Why Studying Abroad is a Career Game-Changer

For years, the “year abroad” was often seen as little more than a chance for students to find themselves, explore new…

By Siya

The American Dream in Doubt: Nine in Ten International Students Fear for US Visa Status

The pursuit of an American education, a symbol of opportunity for millions across the globe, is now shadowed by a…

By Henry

US Visa Delay Disaster: New Vetting Leaves Indian Graduates Stranded Until Summer 2026

For thousands of Indian students and recent graduates dreaming of a US career, a sudden and alarming policy change has turned…

By Vaidant

Germany Hits 400,000 Milestone: International Student Numbers Surge

Germany has cemented its status as one of the world’s most attractive destinations for higher education, after recent figures revealed…

By Jace

UK Universities Face Second-Year Slide in International Postgraduates

The welcome mats are feeling a little less crowded at Britain’s universities this autumn, as figures confirm a second…

By Ezra

The End of the Gold Rush? North America’s Overseas University Campuses Face a Reckoning

The glittering promise of Transnational Education (TNE); establishing fully-fledged university campuses abroad, appears to…

By Advay

Canada’s CAD$1.7bn Bid for Global Brainpower

In a significant move signalling its ambition to become a global research titan, Canada has unveiled a colossal…

By Siya

UK Government Cracks Down on ‘Rogue’ University Franchises

The UK Government is finally taking decisive action to clean up a murky corner of the higher education…

By Henry

Aussie Academics Boost Sri Lankan Higher Education with Third University Campus

The landscape of higher education in Sri Lanka is undergoing a transformative shift as Charles Sturt University (CSU) prepares…

By Jace

Australian Minister Praises Surge in Indian Students, Calls Out Shady Agent Practices

The Assistant Minister for International Education, Julian Hill, has celebrated the impressive contribution of Indian students…

By Kai

Sciences Po Turns the Spotlight on India in Ambitious French Education Drive

France’s prestigious social science institution, Sciences Po, is making a significant and deliberate push into…

By Neerav

Tech Titans Team Up: SAP and SRH University Forge Groundbreaking Digital Skills Partnership

The global technology skills gap is a pressing issue, but a major new partnership between the software giant SAP and…

By Daniel

US Travel Ban Expansion Threatens Global Education Hopes

The United States is poised to dramatically widen its existing travel ban to encompass more than 30 countries, a…

By Aahana

Loughborough Opens the Doors: UK’s First US-Style Sport Showcase for Global Student-Athletes

Loughborough University, the undeniable powerhouse of UK sport, is set to make history by hosting a landmark recruitment…

By Siya

Essex Uni Axes Southend Campus Amid Financial Storm

The University of Essex has delivered a devastating blow to staff and students, announcing the closure of its…

By Jace

Regulatory Crisis: Visa Uncertainty and Funding Mandates Strain US University Business Models

American universities are bracing themselves for a potential crisis as they struggle to manage the impact of…

By Henry

Wales Rolls Out the Welcome Mat: No Extra Tax on International Students

In a move that strongly differentiates its approach from Westminster’s, the Welsh Government has confirmed that…

By Vaidant

US Early Decision System Leaves International Students in a ‘Gamble’

The highly competitive world of US university admissions is creating an impossible bind for international students, with the…

By Neerav

Japanese Giant Snaps Up Australia’s Top Student Accommodation Provide

In a significant cross-border move cementing the global appeal of Australia’s education sector, Japanese…

By Kai

The Great Indian Student Exodus: Are Tougher UK Visa Rules Shutting the Door on Britain’s Global Talent?

The United Kingdom is witnessing a dramatic shift in its migration landscape, with Indian nationals now…

By Advay

Kiwis and Classrooms: How Foreign Students are Boosting New Zealand’s Economy by NZ$4.5 Billion

The latest figures paint an exceptionally sunny picture for New Zealand’s international education sector, which is…

By Henry

US Bill to Double H-1B Visas: A Major Boost for Indian Students and Professionals

The landscape for Indian professionals and students seeking work in the United States could soon be…

By Ezra

New Zealand’s Tertiary Education Strategy: A Blueprint for Future Success

New Zealand has launched its ambitious Tertiary Education Strategy (TES) for 2025–2030, a vital blueprint for equipping…

By Daniel

Beyond the Border: US Students Seek Safety and Stability in Foreign Education

A significant and deeply human shift is reshaping the international education landscape, as a growing…

By Siya

UK Home Office Set to Revolutionise English Testing with ‘Digital-First’ Remote Exams

The UK Home Office is pressing ahead with ambitious plans to modernise the English language testing required for many…

By Advay

Swiss Expertise to Supercharge Saudi Hospitality: A €140m Investment in Future Talent

A groundbreaking partnership, worth approximately €140million (SAR 600 million), has been forged between…

By Ezra

US Universities Face $1 Billion Hit as Overseas Student Numbers Plummet

The prestigious world of US higher education is reeling from a significant economic blow, with a sharp drop…

By Henry

Trump Proposes Sweeping, Permanent Pause on Migration from ‘Third World Countries’

The political landscape in the United States has been shaken once more as President Donald Trump announced…

By Vaidant

Kiwi Dream: New Zealand’s Student Visa Success Rate Soars Despite Application Dip

The pursuit of an education in New Zealand appears to be smoother and more certain for international students, even as…

By Kai

Canada’s Student Cap: Sector Warns Reduced Target is Still Out of Reach

The Canadian government’s attempt to cool down its international student programme is facing a sharp reality…

By Siya

Australia Pushes Controversial Education Overhaul Through Senate

The Australian government has finally managed to push its hotly contested education reform bill through the…

By Henry

UK Universities Bracing for Impact as International Student Fee Levy Details Emerge

The introduction of a new £925 annual levy on international students attending English universities has…

By Ezra

The Two Sides of UK Study Visas: Demand Holds Steady as Family Dreams Are Dented

The latest Home Office migration statistics paint a complex picture for the UK’s international…

By Daniel

UK Universities Brace for £330 Million Hit from New International Student Tax

England’s higher education sector is facing a potentially devastating financial blow, with new government plans…

By Henry

Uzbekistan’s Global Education Leap: Diplomas Gain Worldwide Recognition

Uzbekistan has marked a significant moment for its higher education sector, stepping onto the global…

By Jace

US Ambassadors Demand End to Student Visa Crackdown

A powerful cross-party group of more than 60 former US ambassadors and senior diplomats has made an urgent…

By Neerav

Malta’s English Schools: The High Cost of the Discount Habit

The sun-drenched island of Malta has long been a top destination for students from across the globe looking…

By Vaidant

A Breath of Fresh Air for Global Students: The US Plans to Scrap the ‘Intent to Leave’ Visa Rule

For generations of aspiring international students, securing a US F-1 study visa has been a high-stakes, nerve-wracking…

By Aahana

Rethinking the ROI: Indian Students Weigh Alternatives as US Immigration Uncertainty Grows

For generations, the United States has stood as the gold standard for higher education, especially in the coveted…

By Daniel

European Campuses Overtake US as Top Choice for Indian Students

For decades, the United States has been the ultimate prize for ambitious Indian students looking to secure a world-class…

By Daniel

US Study Abroad Programmes in Limbo as State Department Takes Over

The landscape of US international education is undergoing a seismic shift. In a move that has both relieved and…

By Kai

Green Light for Education Overhaul: Aussie Bill Edges Closer to Law

The wheels of Australian parliament are turning once again on a critical piece of legislation, as a key Senate…

By Siya

London’s Business Elite Back Global Graduates as Vital to UK Success

A recent survey has delivered a resounding message from London’s business leaders: international graduates…

By Ezra

Canada’s Big Squeeze: What the Budget Means for Global Students

The Canadian government has sent a clear message with its 2025 federal budget: the welcome mat for new…

By Henry

Enrolments Fall in North America as Students Turn to Asia and Europe

North America — particularly the U.S. and Canada — is experiencing a noticeable decline in international student enrolment…

By Advay

China and Japan Release Safety Alerts for Students Amid Growing Tensions

China and Japan have both issued fresh safety advisories for their students studying abroad, reflecting increasing…

By Aahana

Australia Issues a Tough Warning Over Student Visa Integrity Threats

The Department of Home Affairs (DHA) in Australia has raised the alarm about growing risks to the integrity of the…

By Henry

International Enrolments at UK Business Schools Show Signs of Recovery

International student numbers at UK business schools are slowly bouncing back after a challenging few years…

By Ezra

UK Business Schools See Promising Turnaround in Overseas Student Intake

The landscape for UK business schools is showing welcome signs of improvement in international student…

By Daniel

New Zealand Raises Work-Hour Cap for International Students — and Issues Exploitation Warning

From 3 November 2025, eligible international students in New Zealand will be allowed to work up to 25 hours per week…

By Siya

Germany’s Skills Hunt: Top High-Demand Jobs for Global Talent

Germany is fast becoming the go-to destination for skilled professionals from around the world, especially as other popular…

By Jace

Russian Boost for Indian Students: 300 Scholarships on Offer

Indian students dreaming of a world-class education with a touch of adventure have just been handed a fantastic…

By Neerav

IELTS ‘Technical Glitch’ Sparks Global Score Chaos and Apology

The International English Language Testing System (IELTS) has issued a significant apology following the discovery of…

By Vaidant

CBSE Draft Curriculum Proposes Widespread Integration of Computational Thinking and AI

The Central Board of Secondary Education (CBSE) has prepared a progressive draft curriculum aimed at…

By Jace

Malta Sees 27% Surge in International Higher Education Students

Malta is emerging as a significant player in the global education market, with new statistics confirming a dramatic surge in…

By Daniel

‘Wretched’ International Fee Levy Threatens UK Universities, Warns UUK Boss

The head of Universities UK (UUK), Vivienne Stern, has launched a fierce attack on the government’s idea to introduce a levy…

By Advay

Trump Defends Foreign Students, Citing Economic Impact on US Colleges

President Donald Trump recently defended the presence of international students in U.S. universities, pushing…

By Aahana

Germany Emerging as the Next Hotspot for Indian Medical Aspirants

With low to no tuition fees, EU recognition, and rising doctor demands in Germany, the nation is…

By Kai

US Revokes 8,000 Student Visas in Broad Immigration Crackdown

The Trump administration has confirmed the revocation of more than 8,000 US student visas since…

By Ezra

New ‘Student-centred’ Award to Redefine UK-India Education Agent Recognition

The prestigious India-UK Achievers Honours, a flagship initiative of the National Indian Students & Alumni Union…

By Neerav

Australia Introduces New Student Visa Rule: Processing Times Now Linked to University Compliance

The Australian government has announced a significant policy shift in its management of the international education…

By Henry

CBSE Set to Launch Global Curriculum in UAE and Other Nations from April 2026

The Central Board of Secondary Education (CBSE) is taking a significant leap toward internationalisation by announcing the…

By Henry